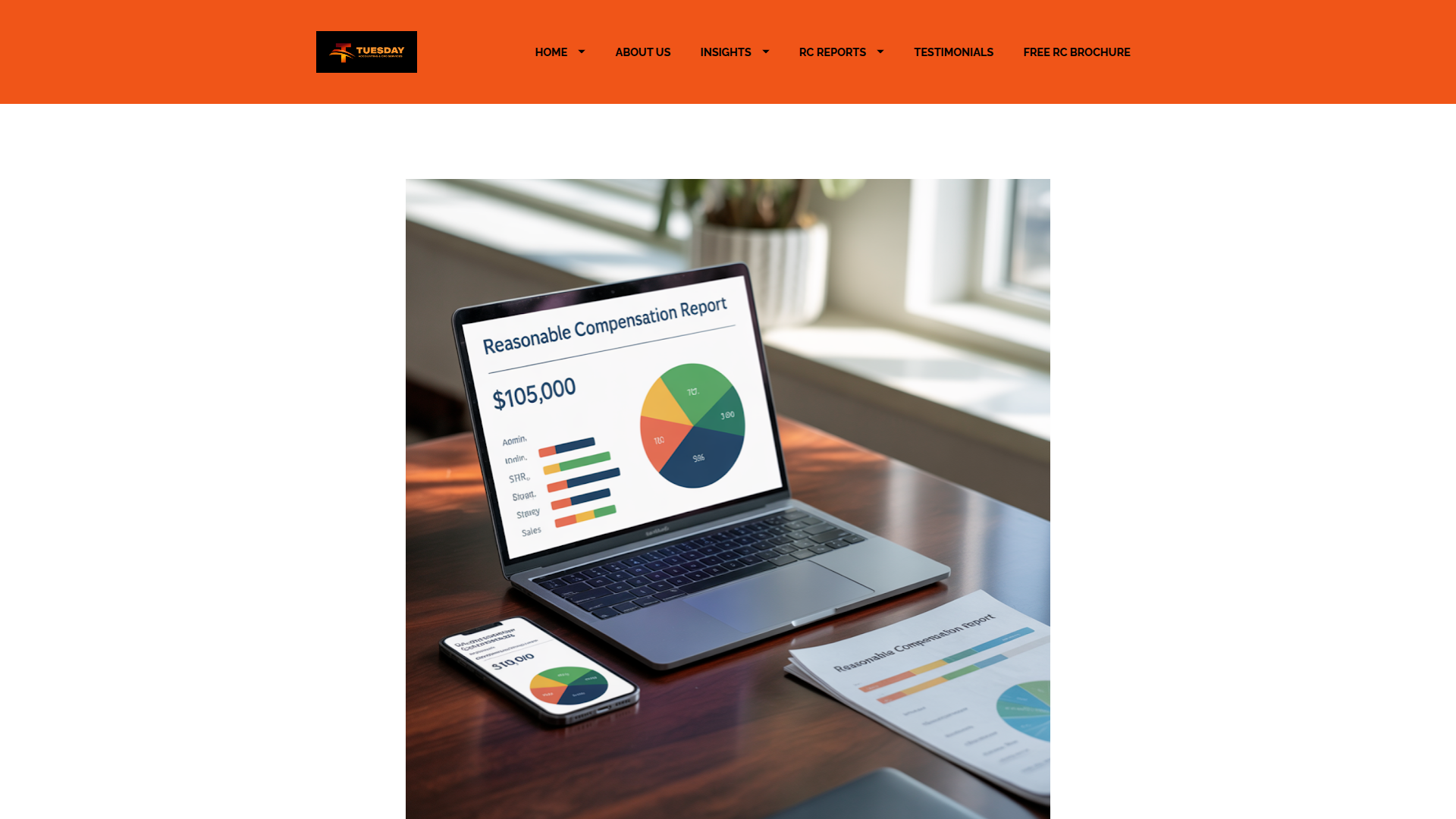

S-Corp Reasonable Compensation Analysis

Protect your S-Corporation with an IRS-approved Reasonable Compensation Report. Stop guessing what to pay yourself and get defensible documentation.

What Is an RCReport?

An RCReport is an IRS-approved Reasonable Compensation Analysis that determines the appropriate salary for S-Corporation owner-employees. It provides defensible documentation that protects you during audits and ensures compliance with tax regulations.

Learn more at ReasonableCompReport.comIRS-Approved Documentation

Our reports use the same methodology accepted by the IRS, providing you with defensible compensation analysis.

Data-Driven Analysis

We analyze market data, job duties, and industry standards to determine your reasonable compensation amount.

Audit Protection

Having an RCReport provides solid documentation if you're ever questioned by the IRS about your salary.

When Was Your Last RC Report?

S Corporation Owners - When was your last Reasonable Compensation Analysis performed? If the answer is last year, it's time to do it now. If the answer is never, that needs to change today.

Without an IRS-approved Reasonable Compensation Analysis, you are probably paying yourself too little or paying yourself too much. Both situations create risk.

IRS Alert: Reasonable compensation is a top audit trigger for S-Corporations. Protect yourself with proper documentation.

Why You Need an RCReport

Compliance & Risk Management

We show our clients that we have their back when it comes to compliance and risk management.

FICA Tax Optimization

Understand why FICA taxes matter and how proper compensation planning can save you money legally.

Salary Protection

Learn how we protect your salary determination with comprehensive market analysis and documentation.

Smart Business Investment

Smart owners invest in RCReports because the cost of an audit far exceeds the cost of proper documentation.

The IRS Way to Pay Yourself

The IRS requires S-Corporation shareholder-employees to receive "reasonable compensation" for services rendered. This isn't optional—it's the law. Our RCReports ensure you're paying yourself the right amount, documented the right way.

Get Your Reasonable Compensation Report Today

Don't wait for an IRS audit to question your salary. Get defensible documentation that protects your S-Corporation.