Our 6-Step Plan to Pay Less Tax (Legally)

Tax Assessment (AI-Powered + Expert Reviewed)

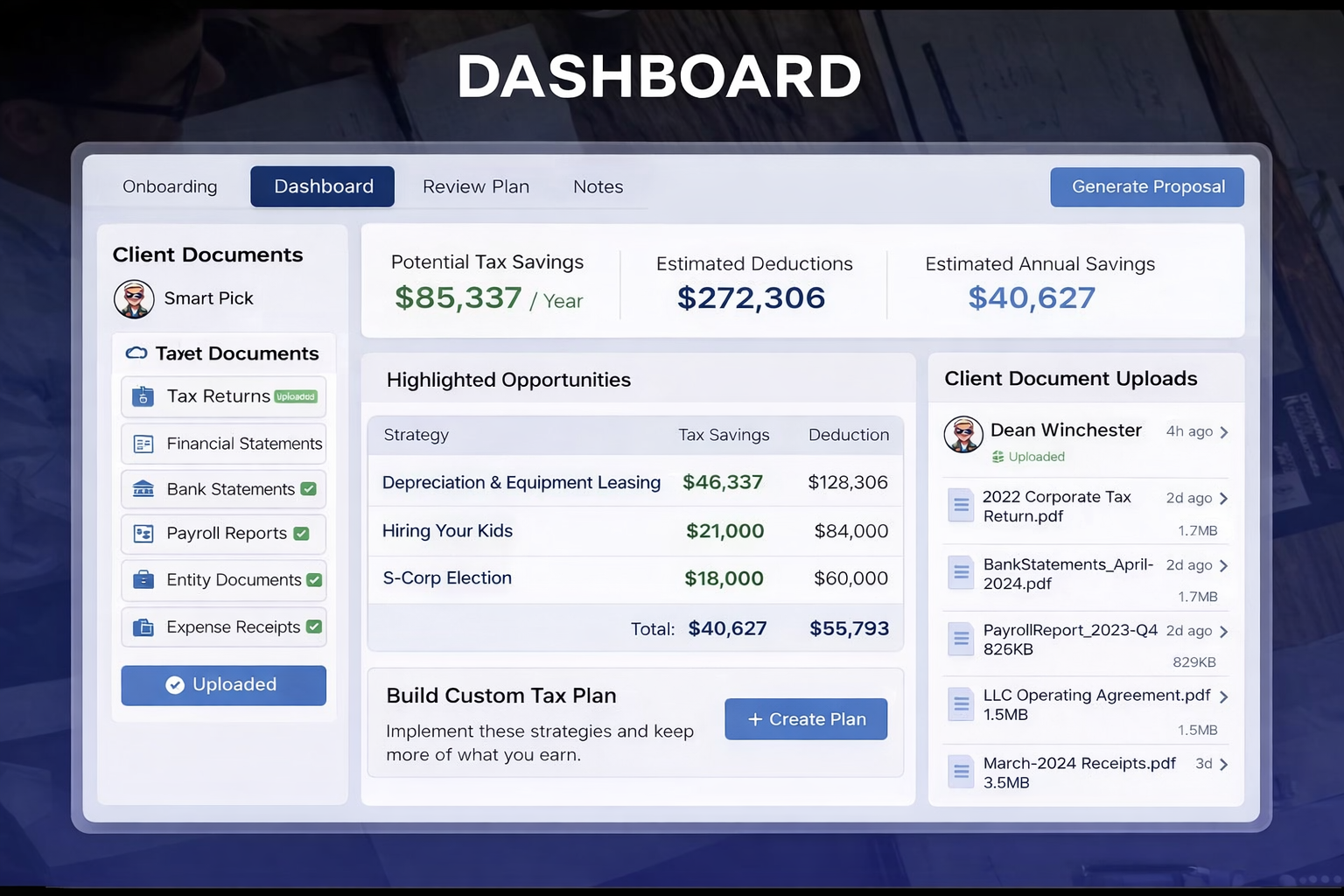

We start with a Tax Assessment using AI-powered tax planning software that's continuously updated with current federal and state tax laws. You'll securely share a few key documents, and we'll run a detailed analysis to identify where you may be overpaying, what opportunities you're missing, and which strategies actually fit your business.

Then we translate that analysis into a clear, client-ready snapshot: estimated savings opportunities, before-and-after comparisons, and a simple breakdown of the strategies we recommend—so you can see the value, understand the "why," and decide quickly on next steps.

Secure Document Intake & Data Review

Next, we collect your key documents through a secure portal — prior-year tax returns, bookkeeping reports, payroll details, entity documents, and anything else that impacts your tax picture. No more email chains, missing attachments, or "Can you resend that?"

From there, our AI-powered tools organize the information and surface the details that matter most for planning, while our team reviews everything for accuracy and context. That means less manual back-and-forth, faster clarity, and a clean foundation to build the right tax strategies (and the right protections) around your specific business.

Bottom line: fewer documents to chase, less busywork, and a faster path to real savings — backed by expert review.

Automated Analysis & Strategy Modeling

Now we run your documents and answers through AI-powered analysis to organize the data, spot gaps, and model the tax strategies that could reduce what you owe. This is where your tax plan starts taking shape—because we're not guessing, and we're not speaking in accounting riddles; we're mapping real options to real dollars.

You'll see a clear picture of your projected current-year tax liability, a review of the past two years for missed opportunities, and side-by-side strategy scenarios across entity structure, retirement planning, real estate, and basic asset-protection considerations. Then our team reviews the results, narrows the strategies that truly fit your situation, and prepares the recommendations in plain English—so you understand what we're doing and why.

Bottom line: smarter planning, faster insights, and recommendations backed by your real numbers—not generic advice.

Your Tax Plan + Proposal (Client-Ready, One Click)

Once we finalize the best strategies for your situation, we generate a polished, easy-to-understand tax plan that lays everything out clearly—what we found, what we recommend, what it should save you, and what it costs to implement. No jargon. No confusion. Just a clean plan you can approve with confidence.

You'll receive two client-ready deliverables:

Tax Savings Assessment Report — a professional summary of your recommended strategies, projected savings, and next steps.

Tax Plan Presentation Deck — a simple slide deck (Google Slides or PowerPoint) customized with your numbers and pricing, designed to make the value crystal clear.

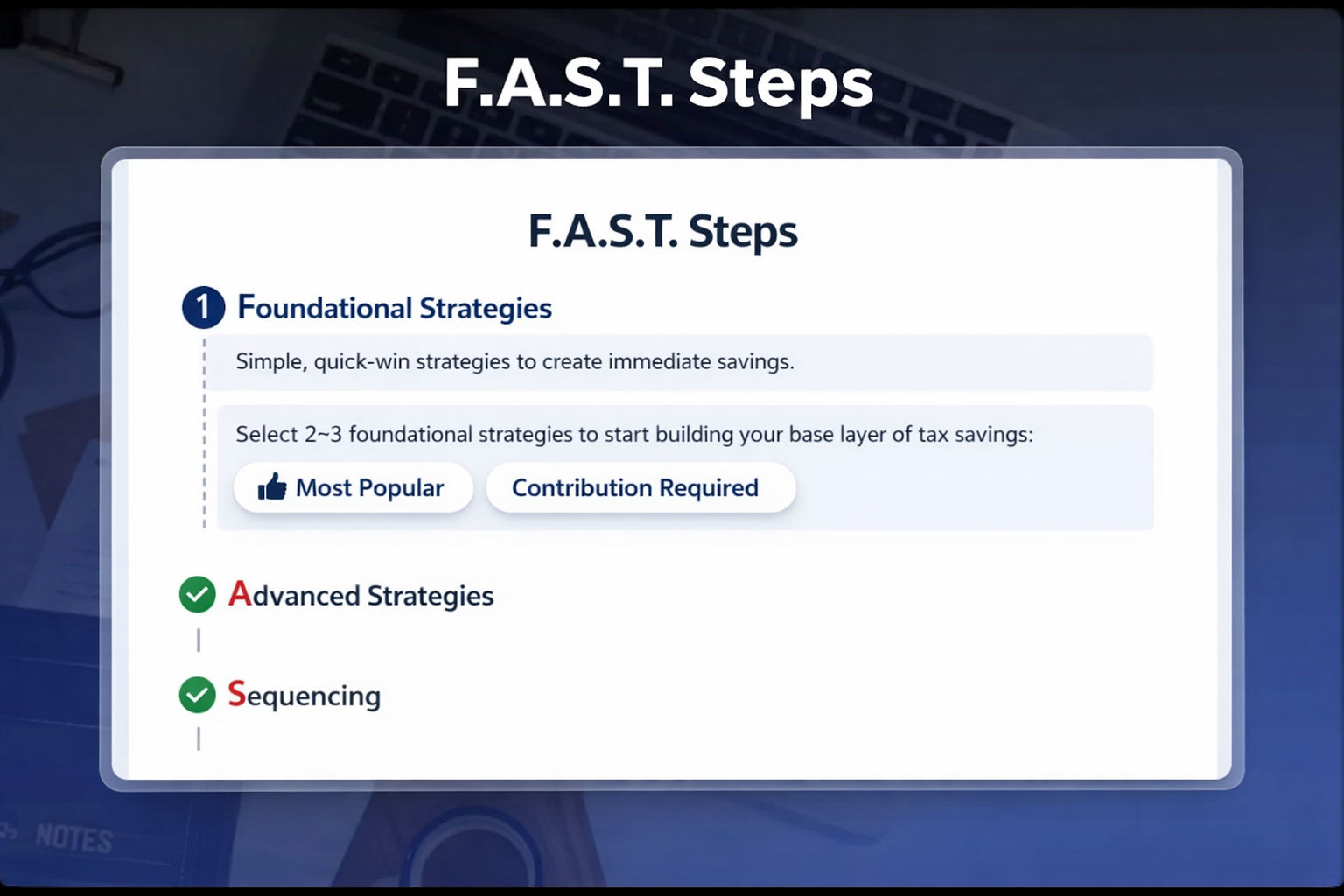

We follow our F.A.S.T. Framework—Foundational, Advanced, Strategic, Tactical—so your plan starts with the basics, then moves into higher-impact strategies as they make sense for your business.

Price, Propose, Enroll

Once your tax strategy is finalized, we package everything into a clear proposal: what we're doing, what it should save, your implementation timeline, and the fee—no confusion and no surprise invoices. You review it, sign electronically, and enroll in minutes, so we can move from planning to execution fast. Behind the scenes, we keep your plan and progress organized in one place—tax year tracking, projected savings, implementation status, and next steps—so nothing falls through the cracks.

Track Implementation & Results

Once you enroll, we don't just hand you a plan and disappear. We track every strategy through implementation—what's in progress, what's completed, and what's due—so your tax plan actually gets executed. You'll have clear visibility into progress, key milestones, and results, turning "projected savings" into real outcomes.

Ready to Start Your Tax Planning Journey?

Book your free discovery call today. No obligation — just a clear plan for keeping more of what you earn.

Book Your Free CallNo obligation. Cancel anytime.