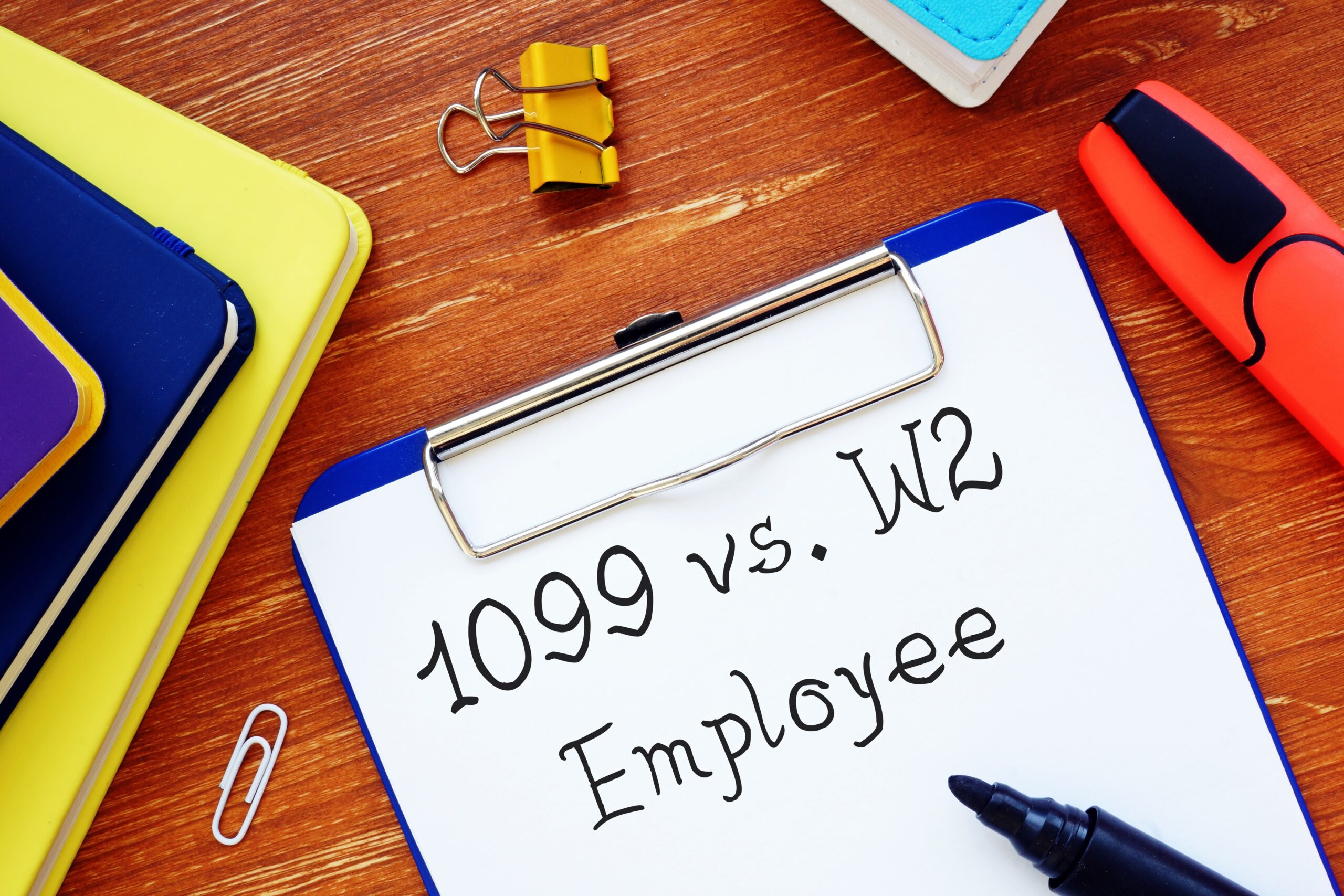

W-2 and 1099 Reporting: Compliance & Non-Compliance Risks

As the end of the year approaches, employers are required to file accurate W-2 and 1099 forms. Ensuring compliance is not only a legal obligation but also a vital part of maintaining smooth operations and avoiding penalties.